Speed and

Communication

We can get your report to you within 48 hours. Our company continues to get rave reviews on our clear communication with our clients. No more long waiting periods while you wonder where your order is.

Appraisals

Appraisal Reviews

Other Services

The Patriot Difference

Patriot AMC is one of a handful of Woman Owned Appraisal Management Companies in the United States. Our focus on quality, customer service and dedication to both our clients and vendors is what sets us apart.

Who We Are

We value our clients and their borrowers, and we understand that time is of the essence when closing a loan. We are committed to exceeding our employees, clients, and appraisers expectations. At Patriot AMC, we are proud to be your Appraisal Management Company and we look forward to having you on board to experience the superior service you deserve!

“Over the last 8 years, working with Heidi has been a pleasure. She has amazing customer service and goes above and beyond to help the appraisal ordering/delivering process go smoothly. Definitely one of my favorite individuals to get the opportunity to work with.”

Lauren Dewey

Administrative Assistant at Ritchie and Allen Appraisal Services

Get in Touch

Contact us with any questions or concerns!

"*" indicates required fields

Why Appraisal Management Companies?

Appraisal Management Company (AMC) The Regulatory Role:

AMCs work with lenders and appraisers to facilitate the ordering, tracking, quality control and delivery of appraisal reports. In 2008-09 rules were developed to isolate parties with a financial interest in a mortgage loan transaction from appraiser selection and retention. While those initial rules are no longer in force, they did influence the Appraiser Independence rules now found in The Dodd-Frank Wall Street Reform and Consumer Protection Act. As a result, AMCs have grown as many lenders use their services in order to provide strict adherence to Dodd-Frank, Truth in Lending and Interagency Guidelines.

There are two ways lenders can comply with Federal Law:

- Order Appraisals through an AMC, with the minimal cost passed on to the borrower.

- Create an in-house appraisal/evaluation management and review department at the lender’s expense. It’s not just separating the appraisal/evaluation ordering from the loan production staff, it’s also reviewing the appraisal and evaluation to ensure it meets USPAP and Appraisal Standards.

Appraisal Process – THE Appraisal Management Company (AMC) ROLE:

The AMC performs the managerial functions involved in the ordering, completion, and delivery of a Real Estate appraisal report. Every AMC establishes procedures to complete and/or enhance these functions based on the AMCs business products, customer base and corresponding Federal and State regulatory requirements. AMCs do not perform appraisals.

An AMC engages an appraiser and assigns the appraisal using extensive criteria standards. Criteria that typically includes local experience and proximity to the subject property, license level, education, access to the appropriate MLS, previous appraisal report quality, turn-time performance adherence and workload at the time the order is received.

The AMC confirms the borrower’s contact information, the lender’s additional comments/instructions, and the due date and then places the order with the appraiser. During the appraisal process, the AMC may communicate with the appraiser and request updates on possible issues or problems. After an appraiser completes a report, the appraisal is sent securely to the AMC. After this process, the appraisal is available to the lender/Client.

There is an ongoing assessment process that AMCs use to measure and track appraiser performance in order to monitor an appraiser’s eligibility for continued appraisal assignments. These include on-time performance, communication, and the number of revisions required.

What is the reason for an appraisal management fee?

An appraisal management fee is charged when an appraisal management company oversees the appraisal process. This fee is charged separately from the appraisal fee itself and passed on to the consumer at closing, not the bank. Appraisal management fees ensure that appraisal management companies are compensated for their work during the appraisal process. AMCs play a major role in ensuring the accuracy, fairness, and transparency of an appraisal. While independent appraisers undergo rigorous training, appraisal management companies can ensure that training remains relevant while confirming that appraisals are accurate and unbiased. AMCs will also maintain records on appraisers to ensure that they are using the best of the best — individuals who are dedicated will produce an accurate, quality report.

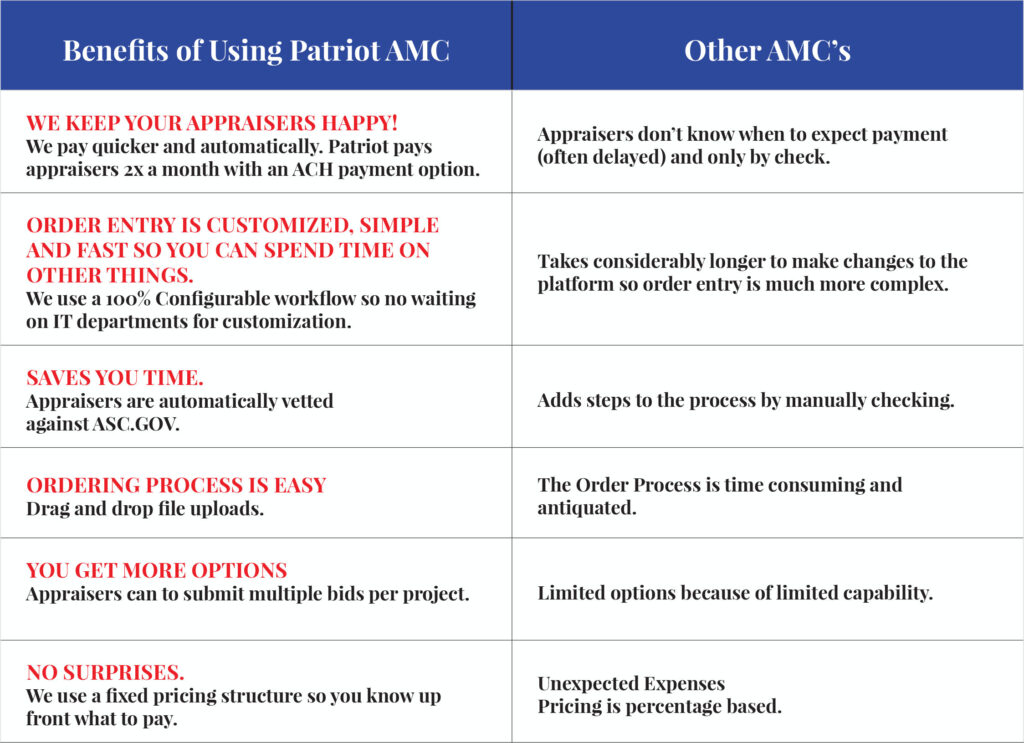

THE PATRIOT DIFFERENCE:

- Communicates effectively. We ALWAYS answer the phone when you call.

- Has in-depth knowledge of your requirements and the appraisers’ challenges.

- High-quality work and dedication.

Call us today to learn more – 918-277-9966.